The Economist was founded by the British businessman and banker James Wilson in 1843, to advance the repeal of the Corn Laws, a system of import tariffs.[13][14] A prospectus for the newspaper from 5 August 1843 enumerated thirteen areas of coverage that its editors wanted the publication to focus on:[15]

- Original leading articles, in which free-trade principles will be most rigidly applied to all the important questions of the day.

- Articles relating to some practical, commercial, agricultural, or foreign topic of passing interest, such as foreign treaties.

- An article on the elementary principles of political economy, applied to practical experience, covering the laws related to prices, wages, rent, exchange, revenue and taxes.

- Parliamentary reports, with particular focus on commerce, agriculture and free trade.

- Reports and accounts of popular movements advocating free trade.

- General news from the Court of St James’s, the Metropolis, the Provinces, Scotland, and Ireland.

- Commercial topics such as changes in fiscal regulations, the state and prospects of the markets, imports and exports, foreign news, the state of the manufacturing districts, notices of important new mechanical improvements, shipping news, the money market, and the progress of railways and public companies.

- Agricultural topics, including the application of geology and chemistry; notices of new and improved implements, state of crops, markets, prices, foreign markets and prices converted into English money; from time to time, in some detail, the plans pursued in Belgium, Switzerland, and other well-cultivated countries.

- Colonial and foreign topics, including trade, produce, political and fiscal changes, and other matters, including exposés on the evils of restriction and protection, and the advantages of free intercourse and trade.

- Law reports, confined chiefly to areas important to commerce, manufacturing, and agriculture.

- Books, confined chiefly, but not so exclusively, to commerce, manufacturing, and agriculture, and including all treatises on political economy, finance, or taxation.

- A commercial gazette, with prices and statistics of the week.

- Correspondence and inquiries from the newspaper’s readers.

Wilson described it as taking part in “a severe contest between intelligence, which presses forward, and an unworthy, timid ignorance obstructing our progress”

In the currency disputes of the mid nineteenth century, the journal sided with the Banking School against the Currency School. It criticised the Bank Charter Act of 1844 which restricted the amount of bank notes that the Bank of England could issue on the basis of Currency School policy encouraged by Lord Overstone, that eventually developed into monetarism. It blamed the 1857 financial crisis in Britain on ‘a certain class of doctrinaires’ who ‘refer every commercial crisis and its disastrous consequences to “excessive issues of bank notes”.[22][23] It identified the causes of the financial crisis as variations in interest rates and a build-up of excess financial capital leading to unwise investments

Monetarism is a school of thought in monetary economics that emphasizes the role of policy-makers in controlling the amount of money in circulation. It gained prominence in the 1970s, but was mostly abandoned as a practical guidance to monetary policy during the following decade because the strategy was found to not work very well in practice.[1]: 483–484 Instead, inflation targeting through movements of the official interest rate became the dominant monetary policy strategy.

The monetarist theory states that variations in the money supply have major influences on national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy.[2] Monetarism is commonly associated with neoliberalism

A Monetary History of the United States, 1867–1960 is a book written in 1963 by Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the U.S. economy, especially the behavior of economic fluctuations. The implication they draw is that changes in the money supply had unintended adverse effects, and that sound monetary policy is necessary for economic stability. Orthodox economic historians see it as one of the most influential economics books of the century.[1][2] The chapter dealing with the causes of the Great Depression was published as a stand-alone book titled The Great Contraction, 1929–1933.

The book’s main theme is the money supply. It tracks this through three numbers:

- the ratio of cash that people hold in their checking deposits (when people trust banks, they deposit more of their money)

- the ratio of bank deposits to bank reserves (when banks feel safer, they loan out more of their money)

- high-powered money (that is, anything that serves as cash or reserves)

The money supply (cash + deposits) can be computed from these three numbers. The supply shrinks when people withdraw money from the bank, banks hold more reserves, or high-powered money leaves the country (e.g., gold is exported). During a crisis, all three can happen.

Another theme is gold. For the time period, it was the unit used for international trade with Europe. So even when the US is not on the gold standard, it plays a significant role. The authors are precise about the gold standard. The authors say the US was on the gold standard from 1879 to 1923. That is, paper money could be exchanged for bullion and international trade was settled immediately with gold. From 1923 to 1933, the authors say that international trade was “sterilized” by the Fed inflating the money rather than immediately being settled by gold. Lastly, they term the period from 1934 to 1960 (when the book was published) as a “managed standard”. Paper money cannot be exchanged for bullion. The authors compare gold to a subsidized commodity, like grain.

Another theme is silver. China and Mexico used it for their currency and the US used it for smaller coins. From 1879 to 1897, there was a populist push to switch the gold-backed dollar to silver. The US Treasury bought silver, but that didn’t help when the country was on gold. Later, during the Great Depression, the US bought gold at inflated prices to help silver miners. The result was tragic for the money supplies of China and Mexico.

The authors measure the velocity of money. The authors talk about it a lot, but do not make any conclusions about it.

Lastly, a theme is decision making at the Federal Reserve. The authors try to find out the people making the decisions and what information they had. Probably just as important is the decision-making process. The NY Fed Bank initially lead the decision-making process, but eventually it migrated to the Federal Reserve Board in Washington, DC. To a lesser extent, the Secretary of the Treasury’s decisions are included.

The book was the first to present the then novel argument that excessively tight monetary policy by the Federal Reserve following the boom of the 1920s turned an otherwise normal recession into the Great Depression of the 1930s. Previously, the consensus of economists was that loss of investor and consumer confidence following the Wall Street Crash of 1929 was a primary cause of the Great Depression.[citation needed]

The Monetary History was lauded as one of the most influential economics books of the twentieth century by the Cato Institute book forum in 2003.[8] It was also cited with approval in a 2002 speech by then-Federal Reserve board member Ben Bernanke stating “the direct and indirect influences of the Monetary History on contemporary monetary economics would be difficult to overstate”,[9][10] and again in a 2004 speech as “transform[ing] the debate about the Great Depression”.[7]

The Depression-related chapter of A Monetary History was titled “The Great Contraction” and was republished as a separate book in 1965. Some editions include an appendix[11] in which the authors got an endorsement from an unlikely source at an event in their honor when Ben Bernanke made this statement:

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate.[1] They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

There was an initial stock market crash that triggered a “panic sell-off” of assets. This was followed by a deflation in asset and commodity prices, dramatic drops in demand and the total quantity of money in the economy, and disruption of trade, ultimately resulting in widespread unemployment (over 13 million people were unemployed by 1932) and impoverishment. However, economists and historians have not reached a consensus on the causal relationships between various events and government economic policies in causing or ameliorating the Depression.

Current mainstream theories may be broadly classified into two main points of view. The first are the demand-driven theories, from Keynesian and institutional economists who argue that the depression was caused by a widespread loss of confidence that led to drastically lower investment and persistent underconsumption. The demand-driven theories argue that the financial crisis following the 1929 crash led to a sudden and persistent reduction in consumption and investment spending, causing the depression that followed.[2] Once panic and deflation set in, many people believed they could avoid further losses by keeping clear of the markets. Holding money therefore became profitable as prices dropped lower and a given amount of money bought ever more goods, exacerbating the drop in demand.

The causes of the Great Depression in the early 20th century in the United States have been

In their 1963 book A Monetary History of the United States, 1867–1960, Milton Friedman and Anna Schwartz laid out their case for a different explanation of the Great Depression. Essentially, the Great Depression, in their view, was caused by the fall of the money supply. Friedman and Schwartz write: “From the cyclical peak in August 1929 to a cyclical trough in March 1933, the stock of money fell by over a third.” The result was what Friedman and Schwartz called “The Great Contraction“[8] — a period of falling income, prices, and employment caused by the choking effects of a restricted money supply. Friedman and Schwartz argue that people wanted to hold more money than the Federal Reserve was supplying. As a result, people hoarded money by consuming less. This caused a contraction in employment and production since prices were not flexible enough to immediately fall. The Fed’s failure was in not realizing what was happening and not taking corrective action.[9] In a speech honoring Friedman and Schwartz, Ben Bernanke stated:

Before the Great Depression, the U.S. economy had already experienced a number of depressions. These depressions were often set off by banking crisis, the most significant occurring in 1873, 1893, 1901, and 1907.[13] Before the 1913 establishment of the Federal Reserve, the banking system had dealt with these crises in the U.S. (such as in the Panic of 1907) by suspending the convertibility of deposits into currency. Starting in 1893, there were growing efforts by financial institutions and business men to intervene during these crises, providing liquidity to banks that were suffering runs. During the banking panic of 1907, an ad hoc coalition assembled by J. P. Morgan successfully intervened in this way, thereby cutting off the panic, which was likely the reason why the depression that would normally have followed a banking panic did not happen this time. A call by some for a government version of this solution resulted in the establishment of the Federal Reserve.[14]

But in 1929–32, the Federal Reserve did not act to provide liquidity to banks suffering bank runs. In fact, its policy contributed to the banking crisis by permitting a sudden contraction of the money supply. During the Roaring Twenties, the central bank had set as its primary goal “price stability”, in part because the governor of the New York Federal Reserve, Benjamin Strong, was a disciple of Irving Fisher, a tremendously popular economist who popularized stable prices as a monetary goal. It had kept the number of dollars at such an amount that prices of goods in society appeared stable. In 1928, Strong died, and with his death this policy ended, to be replaced with a real bills doctrine requiring that all currency or securities have material goods backing them. This policy permitted the U.S. money supply to fall by over a third from 1929 to 1933

Additional modern nonmonetary explanations.

The monetary explanation has two weaknesses. First, it is not able to explain why the demand for money was falling more rapidly than the supply during the initial downturn in 1930–31.[21] Second, it is not able to explain why in March 1933 a recovery took place although short term interest rates remained close to zero and the money supply was still falling. These questions are addressed by modern explanations that build on the monetary explanation of Milton Friedman and Anna Schwartz but add non-monetary explanations.

Debt deflation.

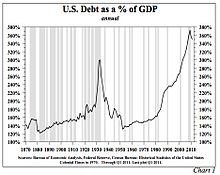

Total debt to GDP levels in the U.S. reached a high of just under 300 per cent by the time of the Depression. This level of debt was not exceeded again until near the end of the 20th century.[22]

Jerome (1934) gives an unattributed quote about finance conditions that allowed the great industrial expansion of the post-W.W.I period:

Irving Fisher argued the predominant factor leading to the Great Depression was over-indebtedness and deflation. Fisher tied loose credit to over-indebtedness, which fueled speculation and asset bubbles.[25] He then outlined nine factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust. The chain of events proceeded as follows:

- Debt liquidation and distress selling

- Contraction of the money supply as bank loans are paid off

- A fall in the level of asset prices

- A still greater fall in the net worths of business, precipitating bankruptcies

- A fall in profits

- A reduction in output, in trade and in employment.

- Pessimism and loss of confidence

- Hoarding of money

- A fall in nominal interest rates and a rise in deflation adjusted interest rates

Bank failures snowballed as desperate bankers called in loans, which the borrowers did not have time or money to repay. With future profits looking poor, capital investment and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending.[27] Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A vicious cycle developed and the downward spiral accelerated.

The liquidation of debt could not keep up with the fall of prices it caused. The mass effect of the stampede to liquidate increased the value of each dollar owed, relative to the value of declining asset holdings. The very effort of individuals to lessen their burden of debt effectively increased it. Paradoxically, the more the debtors paid, the more they owed.[25] This self-aggravating process turned a 1930 recession into a 1933 depression.

Fisher’s debt-deflation theory initially lacked mainstream influence because of the counter-argument that debt-deflation represented no more than a redistribution from one group (debtors) to another (creditors). Pure re-distributions should have no significant macroeconomic effects.

Productivity or technology shock.

In the first three decades of the 20th century productivity and economic output surged due in part to electrification, mass production and the increasing motorization of transportation and farm machinery. Electrification and mass production techniques such as Fordism permanently lowered the demand for labor relative to economic output.[50][51] By the late 1920s the resultant rapid growth in productivity and investment in manufacturing meant there was a considerable excess production capacity.[52]

Sometime after the peak of the business cycle in 1923, more workers were displaced by productivity improvements than growth in the employment market could meet, causing unemployment to slowly rise after 1925.[50][53] Also, the work week fell slightly in the decade prior to the depression.[54][55][56] Wages did not keep up with productivity growth, which led to the problem of underconsumption

- In the book Mechanization in Industry, whose publication was sponsored by the National Bureau of Economic Research, Jerome (1934) noted that whether mechanization tends to increase output or displace labor depends on the elasticity of demand for the product.[23] In addition, reduced costs of production were not always passed on to consumers. It was further noted that agriculture was adversely affected by the reduced need for animal feed as horses and mules were displaced by inanimate sources of power following World War I. As a related point, Jerome also notes that the term “technological unemployment” was being used to describe the labor situation during the depression.

Disparities in wealth and income.

Economists such as Waddill Catchings, William Trufant Foster, Rexford Tugwell, Adolph Berle (and later John Kenneth Galbraith), popularized a theory that had some influence on Franklin D. Roosevelt.[63] This theory held that the economy produced more goods than consumers could purchase, because the consumers did not have enough income.[64][65][66] According to this view, in the 1920s wages had increased at a lower rate than productivity growth, which had been high. Most of the benefit of the increased productivity went into profits, which went into the stock market bubble rather than into consumer purchases. Thus workers did not have enough income to absorb the large amount of capacity that had been added.[50]

According to this view, the root cause of the Great Depression was a global overinvestment while the level of wages and earnings from independent businesses fell short of creating enough purchasing power. It was argued that government should intervene by an increased taxation of the rich to help make income more equal. With the increased revenue the government could create public works to increase employment and ‘kick start’ the economy. In the U.S.A. the economic policies had been quite the opposite until 1932. The Revenue Act of 1932 and public works programmes introduced in Hoover’s last year as president and taken up by Roosevelt, created some redistribution of purchasing power

Gold Standard system.

Main article: Gold standardAccording to the gold standard theory of the Depression, the Depression was largely caused by the decision of most western nations after World War I to return to the gold standard at the pre-war gold price. Monetary policy, according to this view, was thereby put into a deflationary setting that would over the next decade slowly grind away at the health of many European economies.[69]

This post-war policy was preceded by an inflationary policy during World War I, when many European nations abandoned the gold standard, forced[citation needed] by the enormous costs of the war. This resulted in inflation because the supply of new money that was created was spent on war, not on investments in productivity to increase aggregate supply that would have neutralized inflation. The view is that the quantity of new money introduced largely determines the inflation rate, and therefore, the cure to inflation is to reduce the amount of new currency created for purposes that are destructive or wasteful, and do not lead to economic growth.

Financial institution structures.

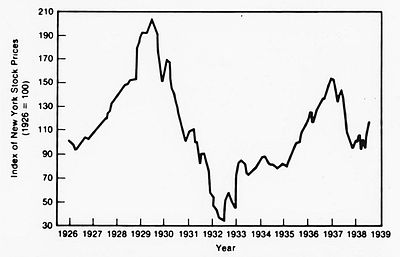

New York stock market index Economic historians (especially Friedman and Schwartz) emphasize the importance of numerous bank failures. The failures were mostly in rural America. Structural weaknesses in the rural economy made local banks highly vulnerable. Farmers, already deeply in debt, saw farm prices plummet in the late 1920s and their implicit real interest rates on loans skyrocket.

Their land was already over-mortgaged (as a result of the 1919 bubble in land prices), and crop prices were too low to allow them to pay off what they owed. Small banks, especially those tied to the agricultural economy, were in constant crisis in the 1920s with their customers defaulting on loans because of the sudden rise in real interest rates; there was a steady stream of failures among these smaller banks throughout the decade.

Governments around the world took various steps into spending less money on foreign goods such as: “imposing tariffs, import quotas, and exchange controls”. These restrictions formed a lot of tension between trade nations, causing a major deduction during the depression. Not all countries enforced the same measures of protectionism. Some countries raised tariffs drastically and enforced severe restrictions on foreign exchange transactions, while other countries condensed “trade and exchange restrictions only marginally”:[81]

- “Countries that remained on the gold standard, keeping currencies fixed, were more likely to restrict foreign trade.” These countries “resorted to protectionist policies to strengthen the balance of payments and limit gold losses”. They hoped that these restrictions and depletions would hold the economic decline.[81]

- Countries that abandoned the gold standard, allowed their currencies to depreciate which caused their Balance of payments to strengthen. It also freed up monetary policy so that central banks could lower interest rates and act as lenders of last resort. They possessed the best policy instruments to fight the Depression and did not need protectionism.[81]

- “The length and depth of a country’s economic downturn and the timing and vigor of its recovery is related to how long it remained on the gold standard. Countries abandoning the gold standard relatively early experienced relatively mild recessions and early recoveries. In contrast, countries remaining on the gold standard experienced prolonged slumps.”[81]

In a 1995 survey of American economic historians, two-thirds agreed that the Smoot-Hawley tariff act at least worsened the Great Depression.[82] However, many economists believe that the Smoot-Hawley tariff act was not a major contributor to the great depression. Economist Paul Krugman holds that, “Where protectionism really mattered was in preventing a recovery in trade when production recovered”. He cites a report by Barry Eichengreen and Douglas Irwin: Figure 1 in that report shows trade and production dropping together from 1929 to 1932, but production increasing faster than trade from 1932 to 1937. The authors argue that adherence to the gold standard forced many countries to resort to tariffs, when instead they should have devalued their currencies.[83] Peter Temin argues that contrary the popular argument, the contractionary effect of the tariff was small. He notes that exports were 7 percent of GNP in 1929, they fell by 1.5 percent of 1929 GNP in the next two years and the fall was offset by the increase in domestic demand from tariff.

Population dynamics.

In 1939, prominent economist Alvin Hansen discussed the decline in population growth in relation to the Depression.[85] The same idea was discussed in a 1978 journal article by Clarence Barber, an economist at the University of Manitoba. Using “a form of the Harrod model” to analyze the Depression, Barber states:

In such a model, one would look for the origins of a serious depression in conditions which produced a decline in Harrod’s natural rate of growth, more specifically, in a decline in the rate of population and labour force growth and in the rate of growth of productivity or technical progress, to a level below the warranted rate of growth.[86]

Barber says, while there is “no clear evidence” of a decline in “the rate of growth of productivity” during the 1920s, there is “clear evidence” the population growth rate began to decline during that same period. He argues the decline in population growth rate may have caused a decline in “the natural rate of growth” which was significant enough to cause a serious depression

Economic policy.

Historians gave Hoover credit for working tirelessly to combat the depression and noted that he left government prematurely aged. But his policies are rated as simply not far-reaching enough to address the Great Depression. He was prepared to do something, but nowhere near enough.[98] Hoover was no exponent of laissez-faire. But his principal philosophies were voluntarism, self-help, and rugged individualism. He refused direct federal intervention. He believed that government should do more than his immediate predecessors (Warren G. Harding, Calvin Coolidge) believed. But he was not willing to go as far as Franklin D. Roosevelt later did. Therefore, he is described as the “first of the new presidents” and “the last of the old”.

Tax policy.

In 1929 the Hoover administration responded to the economic crises by temporarily lowering income tax rates and the corporate tax rate.[106] At the beginning of 1931, tax returns showed a tremendous decline in income due to the economic downturn. Income tax receipts were 40% less than in 1930. At the same time government spending proved to be a lot greater than estimated.[106] As a result, the budget deficit increased tremendously. While Secretary of the Treasury Andrew Mellon urged to increase taxes, Hoover had no desire to do so since 1932 was an election year.[107] In December 1931, hopes that the economic downturn would come to an end vanished since all economic indicators pointed to a continuing downward trend.[108] On January 7, 1932, Andrew Mellon announced that the Hoover administration would end a further increase in public debt by raising taxes.[109] On June 6, 1932, the Revenue Act of 1932 was signed into law.

- In the Cole-Ohanian model there is a slower than normal recovery which they explain by New Deal policies which they evaluated as tending towards monopoly and distribution of wealth. The key economic paper looking at these diagnostic sources in relation to the Great Depression is Cole and Ohanian’s work. Cole-Ohanian point at two policies of New Deal: the National Industrial Recovery Act and National Labor Relations Act (NLRA), the latter strengthening NIRA’s labor provision. According to Cole-Ohanian New Deal policies created cartelization, high wages, and high prices in at least manufacturing and some energy and mining industries. Roosevelts policies against the severity of the Depression like the NIRA, a “code of fair competition” for each industry were aimed to reduce cutthroat competition in a period of severe deflation, which was seen as the cause for lowered demand and employment. The NIRA suspended antitrust laws and permitted collusion in some sectors provided that industry raised wages above clearing level and accepted collective bargaining with labor unions. The effects of cartelization can be seen as the basic effect of monopoly. The given corporation produces too little, charges too high of a price, and under-employs labor. Likewise, an increase in the power of unions creates a situation similar to monopoly. Wages are too high for the union members, so the corporation employs fewer people and, produces less output. Cole-Ohanian show that 60% of the difference between the trend and realized output is due to cartelization and unions.