Over the last three years, household wealth has surged due to a combination of higher stock market returns, rising property values, and pandemic-era fiscal stimulus. However, new research indicates that rampant price inflation has nearly erased all of these gains.

A report by the Wall Street Journal analyzed changes in household net worth from the start of Biden’s presidency in comparison to those seen during the tenure of his predecessor and presumptive opponent in the 2024 election, former President Donald Trump. It found that in nominal terms, total household net worth rose by 19% through Biden’s first three years in office – a comparable figure to the 23% increase seen in Trump’s first three years.

However, when factoring inflation’s impact on household net worth, the data is less favorable for Biden. After adjusting for inflation, household net worth is up by just 0.7% through Biden’s first three years in office, whereas it was up 16% in Trump’s first three years.

By comparison, total nominal household net worth surged by 23 percent in former President Donald Trump’s first 36 months in the White House. After factoring in inflation, it surged by 16 percent.

Despite the sizable increase in household net worth, the current administration’s “policies have largely undermined what’s known in economics as the wealth effect,” says Merrill Matthews, a resident scholar at the Institute for Policy Innovation, a public policy think tank.

The wealth effect is a behavioral economic condition in which consumers spend more when their wealth grows, creating more of a positive attitude toward the economy.

Inflation: A Tale of Two Cities

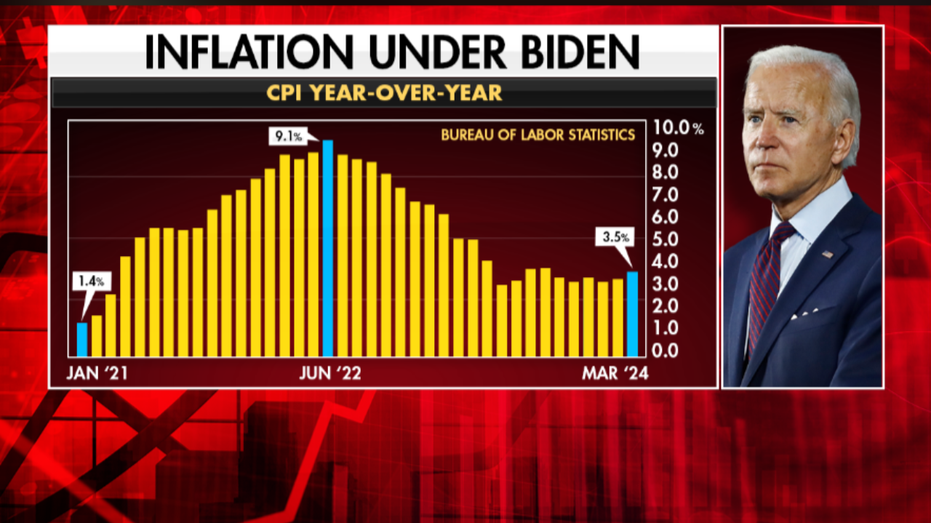

The data illustrate that, on the inflation front, there has been a divergence between the two presidents.

In January 2021, the annual inflation rate was 1.4 percent, accelerating to 9.1 percent in June 2022, the highest in 40 years. Cumulatively, the consumer price index (CPI) has rocketed 19.5 percent.

Inflation was a lot lower under President Biden’s predecessor, with the annual rate never topping 2.4 percent.

“The point that he was making is that the factors that caused inflation were in place when he walked into the administration,” Ms. Jean-Pierre said at a May 15 press briefing.

“The president talked about how concerned he was for households struggling with prices,” Mr. Bernstein stated. “He’s making the point that the factors that caused inflation to climb to 9 percent were in place when he took office.”

Digging Into Household Wealth

In March, the Federal Reserve reported that household wealth climbed to an all-time high of $156.2 trillion at the end of 2023, supported by surging equities and growing property market values.

This was primarily a byproduct of the Fed slashing interest rates in response to the coronavirus pandemic, allowing consumers to lower their borrowing costs.

For example, households could obtain a 30-year mortgage or refinance their mortgages at extremely low rates. This then contributed to the spike in home prices.

However, according to Fed economists, the net worth gains have not been equal. The top 10 percent possess a median net worth of close to $3 million, while the bottom 25 percent maintain a net worth of nearly $4,000.

Meanwhile, bank economists contend that the increase in net worth has propped up consumer spending, which has supported the broader economy.

Market watchers are debating if this trend of consumer spending boosting the GDP growth rate will persist.

A Brookings Institution report argued that accumulated household wealth has dissipated, forcing households to make a choice: slow down their spending or increase their debt burdens.

“The current state of household finances does not support continued strong consumer spending and leaves households at a crossroads if recent trends in finances continue: they can either moderate their spending or become more indebted,” the think tank noted.

Consumer stress is beginning to show up in the data as household debt continues to climb, delinquency rates are inching higher, and the personal savings rate is plummeting.

To kick off 2024, household debt increased by $184 billion to $17.7 trillion. With interest rates remaining elevated, indebted consumers are beginning to face challenges, says Joelle Scally, regional economic principal within the household and public policy research division at the New York Fed.

The personal savings rate plummeted to 3.2 percent, the lowest since August 2022.

A series of corporate earnings reports also suggest that consumers, particularly the low-income demographic, are pulling back in their spending.

Current economic conditions, whether high inflation or mounting debt, have impacted the public’s mood for both themselves and the broader economy.

HOW IT STARTED … HOW IT’S GOING: HOME, ENERGY, CAR BILLS WAY UP THANKS TO INFLATION

Inflation has put a damper on the rising net worth of American households. (ANDREW CABALLERO-REYNOLDS / AFP / Getty Images)

The U.S. spent trillions of dollars to stimulate the economy amid the pandemic at the end of Trump’s administration and at the outset of Biden’s term.

Among those measures were the $1.9 trillion American Rescue Plan Act that was enacted in March 2021 and the Inflation Reduction Act, an $891 billion package enacted in August 2022. The two measures were approved by congressional Democrats on party-line votes using the budget reconciliation process.

The Biden administration has blamed global supply chain disruptions as the main factor causing inflation and has defended those pieces of legislation as providing critical financial support to American households as the economy dealt with the pandemic’s impact and addressing other pressing policy needs.

The White House has also pointed to other actions, like releasing oil from the Strategic Petroleum Reserve to give energy markets a boost, as ways it has looked to ease the sting of inflation.

What is the wealth distribution of the United States households?

What is the 1% wealth in the US?

Does inflation affect the rich?

What is the net worth of the top 5 percent in the US?

What are the causes of wealth inequality in the United States?

What is the top 1 income in the world?

The U.S. economy continues to experience elevated inflation, which came in at 3.4% in April. That’s well above the Federal Reserve’s target rate of 2%.

To tamp down inflation, the Fed raised the benchmark federal funds rate, which influences interest rates across the economy, to a more than 20-year high target range of 5.25% to 5.50%.