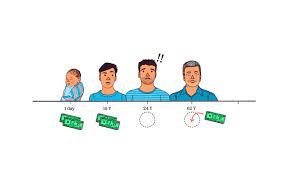

We’ve compiled a list of key birthdays that impact your tax status. Make a note of them. It’ll help you maximize your returns and avoid penalties.On some birthdays, you may age out of a tax credit or age into one. On others, you may be required to take money out of.

Significant tax birthdays, sorted by decade

Even if your baby is born on December 31, they are considered a dependent for the full year, and eligible for the Child Tax Credit.

Age 12: This is the last year your child will be eligible for the Dependent Care Credit (the age limit doesn’t apply if the dependent child is physically or mentally incapable of self-care).

Age 16: This is the last year a child is eligible for the Child Tax Credit.

Age 17: Dependent children are no longer eligible for the Child Tax Credit but may be eligible for the Other Dependent Credit.

The last year you can set up Coverdell Education Savings Accounts contributions for most children. Beneficiaries must be under 18 or be a special needs beneficiary when it’s created.

Age 18: The last year a child can qualify as a dependent if the child is younger than the taxpayer claiming the exemption. The child must be under age 19 at year end, unless the dependent is a full-time student. If the dependent is a student, the dependent must be under 24 at the end of the year. People who are permanently and totally disabled at any time during the year, regardless of age, can be claimed as dependents.

Age 23: The maximum age that the “kiddie tax” applies to dependent full-time students. The “kiddie tax” imposes higher taxes on investment income of children to circumvent parents passing on investments to their kids who may be in lower tax brackets.

Age 24: A child who is a full-time student and younger than the claiming taxpayer ages out as a qualified dependent.

Age 30: Any remaining funds in Coverdell Education Savings Accounts must be distributed within 30 days after the designated beneficiary’s 30th birthday unless the beneficiary is a special needs beneficiary. If you miss this, your distribution will be taxable and subject to a 10% tax.

Age 50: “Catch-up” contributions to retirement plans are allowed. The 2024 catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is $7,500 (up from $6,500 in 2023). For Individual Retirement Accounts (IRAs), the catchup is still $1,000.

Age 55: Once you reach this age, you can separate from your company and take distributions from your company’s retirement plan without paying the additional 10 % early distribution penalty. This only applies to employer plans so IRAs are not exempt.

You can start adding up to $1,000 annually as “catch-up” contributions to a Health Savings Account.

Age 59.5: You can withdraw money from all retirement accounts, including IRAs, without incurring a 10% early distribution penalty.

Taxpayers can take tax-free distributions from Roth IRAs opened for at least five years.

Age 60: Early Social Security benefits can begin for a surviving spouse. Surviving spouses can begin receiving a reduced Social Security benefit based on the deceased spouse’s basic benefit amount. Some Social Security benefits may be taxed, depending on income.

Age 62: Early Social Security benefits can begin. For those claiming early spousal benefits, your benefits can be reduced by up to 67.5%. To see how early retirement impacts your benefits, visit the Social Security Administration site and how it may be taxed at the IRS site.

Age 64: Medicare enrollment begins three months before your 65th birthday and ends three months after. Medicare premiums and many other qualified medical expenses are tax deductible if you’re self-employed or if the amount is above 7.5% of your adjusted gross income.

Age 65: Taxpayer’s standard deduction (and dollar threshold for filing requirement) is increased. In 2023, the additional standard deduction for age 65 and older was $1,500 per taxpayer (so if both spouses are over 65, then its $3,000).

At this age, you may qualify for the Credit for the Elderly or the Disabled. However, income limits are very low to qualify for this credit. The credit ranges between $3,750 and $7,500.

Qualified veterans can begin receiving VA pension benefits, which are tax free.

Age 67: Full retirement age for Social Security for those born since 1960. Here’s how you might get taxed.

Age 70: Delaying Social Security benefits to this age gives you the maximum benefit. “By delaying benefits past the full retirement age, a person’s benefits are increased by 8% per year,” said Richard Pon, a certified public accountant in California. “Keep in mind you have delayed benefits for at least three years, so you have to live a long time to recoup the 3 years of benefits you lost as it will take about 12.5 years for you to break even.”

Age 70.5: Under the December 2019 SECURE Act, if you have earned income (W2 or self-employment income), there’s no longer an age cap (previously age 70.5) for contributing to a traditional IRA. So those over 70.5 can continue to contribute to their IRA.

Age 70.5: The Charitable IRA Rollover allows individuals age 70½ and older to make direct transfers of up to $100,000 in tax year 2023 and $105,000 per year in 2024 (and up to $200,000 in 2023 and $210,000 per year for married couples) from IRAs to qualified charities without having to count the transfers as taxable income. Since no tax is incurred on the withdrawal, gifts do not qualify for an income tax charitable deduction. The Charitable IRA rollover is eligible to be counted toward an individual’s RMD. The new $105,000 limit was effective 2024 and was the first increase in over twenty years.

Age 73: You generally have to start taking required minimum distribution (RMD) withdrawals from your IRA, SEP IRA, SIMPLE IRA, or employer retirement plan account when you reach age 73 (the age 72 limit changed to 73 in 2023 due to Secure Act 2.0). The failure to take an RMD can trigger a 25% penalty. The penalty was 50% until the Secure Act 2.0 decreased this.

Age 100: If you live in Maryland and are at least 100 years old on the last day of the year, you may subtract up to $100,000 of income from your taxes. If you live in New Mexico, you no longer have to pay income tax.

Age 115: IRS Publication 590-B shows an RMD period of 1.8. That means once you hit age 115, your required minimum distribution must be 55.55% of your retirement account.

Age 120+: The RMD shows a distribution period of 1 so once you hit age 120, your required minimum distribution must be 100% of your retirement account.

Key Dates and Deadlines for First Notice Day

First Notice Day is a significant event in the world of futures trading. It marks the beginning of the delivery process for futures contracts, making it a crucial date for traders and investors to be aware of. Understanding the key dates and deadlines associated with First Notice Day is essential to ensure a smooth and successful trading experience. In this section, we will dive into the details of these important dates and provide insights from different perspectives to help you navigate this aspect of clearinghouse rules effectively.

1. Definition and Importance of First Notice Day: First Notice Day is the first day on which a buyer of a futures contract can be called upon to take delivery of the underlying asset, or the seller can be called upon to deliver it. It signifies the start of the delivery period and is a critical milestone for market participants. Traders need to be aware of this date to manage their positions effectively, especially if they do not intend to make or take physical delivery of the underlying asset.

2. Determining First Notice Day: Each futures contract has its own First Notice Day, which is determined by the exchange on which it is traded. It is typically set based on the trading month of the contract, often falling within a specific range of days before the contract’s expiration date. Traders can find the exact First Notice Day for a specific contract by referring to the exchange’s contract specifications or consulting their broker.

3. Last Trading Day vs. First Notice Day: It is important to distinguish between the Last Trading day and First Notice day. The Last Trading Day is the final day on which a futures contract can be traded, while the First Notice Day is the first day on which delivery can be initiated. These two dates are not always the same, and traders must be aware of both to make informed decisions regarding their positions.

4. Deadlines and Obligations: On or before First Notice Day, traders have several obligations and deadlines to meet. These include:

A. Deciding whether to make or take delivery: Traders holding long positions must decide whether to make or take delivery of the underlying asset. This decision depends on various factors such as storage costs, transportation logistics, and the trader’s specific trading strategy. If a trader does not wish to make or take delivery, they must close their position before First Notice Day.

B. Notifying the clearinghouse: Traders intending to make or take delivery must notify the clearinghouse of their intentions before a specific deadline, usually a few days prior to First Notice Day. This allows the clearinghouse to facilitate the delivery process efficiently.

C. Exchange of delivery information: Traders involved in the delivery process must exchange relevant information, such as delivery locations, quality specifications, and delivery instructions, by a designated deadline. This ensures a smooth and orderly delivery process.

5. Best Practices and Considerations: When approaching First Notice Day, traders should consider the following best practices:

A. Plan ahead: It is crucial to have a clear plan in place well before First Notice Day. Traders should assess their trading strategy, market conditions, and their ability to handle physical delivery if necessary.

B. Stay informed: Regularly review contract specifications and stay updated on any changes or announcements related to First Notice Day. This information can be obtained from the exchange, your broker, or other reliable sources.

C. Consult with experts: If you are new to futures trading or have specific questions about the delivery process, it is advisable to consult with experienced traders, brokers, or clearinghouse representatives. Their insights and expertise can provide valuable guidance in navigating this aspect of trading.Understanding the key dates and deadlines for First Notice Day is essential for futures traders. By being aware of these important milestones, traders can effectively manage their positions, make informed decisions, and ensure a smooth trading experience. Whether you are a seasoned trader or a beginner, taking the time to familiarize yourself with the rules and requirements surrounding First Notice Day will undoubtedly contribute to your success in the futures market.